Connect with us for expert investment insights and personalized advice. Stay informed with the latest market trends to make confident financial decisions.

Copyright © Shubh Investment Partners 2024.

All rights reserved.

Investment Philosophy

My investment strategy, which I refer to as the "Broken Angels" approach, centers on identifying and purchasing well-known, branded companies that are temporarily undervalued due to issues such as poor management, inefficient balance sheets, debt burdens, or other temporary setbacks. These companies, although currently disfavored, have strong brand recognition and the potential for significant recovery.

The goal is to acquire these stocks at severely depressed prices, expecting that small operational improvements will lead to a reversion to their true value over time. This strategy is based on the principle of mean reversion, where the stock price is anticipated to recover as the company's operations stabilize and improve. Drawing inspiration from Sir John Templeton's philosophy of buying out of favor assets and the Rothschild principle of investing when there is "blood on the streets," I adopt a contrarian approach.

I deliberately target companies that are overlooked and unpopular during their period of dislocation. By gradually accumulating shares while they are out of favor, I position myself for outsized returns as these companies recover and the market eventually recognizes their true value. In essence, my strategy involves a deep value focus with a long-term horizon, seeking to capitalize on the potential recovery of strong, branded companies that are currently experiencing temporary difficulties.

Deep value concentrated portfolio of 3 to 10 names

Invest in Recognizable Brands facing temporary setbacks available at depressed prices

Long term time horizon

Multi bagger investment framework

Portfolio of three diversified business

Investment Process

Industry Analysis

Company Analysis

Management Analysis

Valuation

Buy Sell Discipline

-

Idea Generation

Screening, industry journals, news publications, company conference calls 10K and 10Q, company presentations, Google alerts, negative news events. Factset, Finbox and Datorama. Seeking alpha, motley fool negative news alerts from Google and Yahoo.

-

Industry Analysis

Economics of the industry, number of players in the industry, competition in the industry, Government regulations in the industry, maturity of the industry, cyclical versus defensive nature of the industry.

-

Company Analysis

Corporate strategy of the company, product portfolio, brand recognition, market share of the company, topline, margins, capex cycle and R&D investment of the company, innovation with in the company

-

Management Analysis

Integrity, transparency, vested interest, compensation structure, guidance versus deliverability of numbers, tenure of the team.

-

Valuation

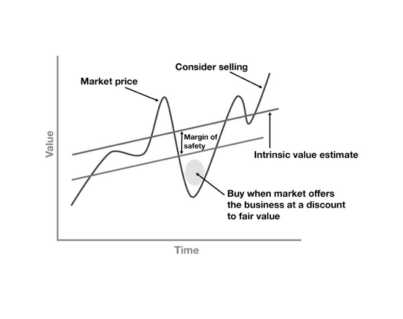

DCF, Multiple analysis, comparable company analysis, Private Market Transaction Value, Margin of safety.

-

Buy-Sell Discipline

Once the price target is established, knowing the catalyst that will crystalize the value creation and reach the price target accordingly sizing up the position. Sell discipline in case the stock reached the price target in absence of any incremental information exit the position.